Multi Asset Funds Investment Strategy

Multi-asset fund combines equities, bonds, silver and international securities, within a single portfolio; a structured

The 2025 India-Pakistan ceasefire acted as a catalyst for a substantial rally in the Indian Stock Market, with the Sensex soaring by approximately 3,000 points and the Nifty50 climbing over 3.5%, marking their strongest single day gains since February 2021. This rally added an impressive Rs. 16.15 lacs crore to Investor wealth, reflecting renewed investor confidence in the market.

While war generally triggers short-term panic selling, the Indian stock market often rises or recovers quickly during geopolitical tensions between India and Pakistan. Why?

A comical reason is Investors quickly realize that there is no full-scale war and so they adopt “Buy the dip” mentality. Following the Pahalgam terror attack, FIIs and DIIs were the net buyers in the immediate week thus demonstrating confidence in India’s economic fundamentals.

India has a large, diversified domestic economy where the markets are driven by corporate earnings, domestic consumption, policy reforms, global liquidity trends, the factors which outweigh temporary geopolitical tensions and trade disruptions.

Ceasefire = Clarity. When a ceasefire or de-escalation is announced, markets price in peace quickly leading to sharp rebounds or continued rallies.

When global liquidity is high, large asset managers like BlackRock, Vanguard, sovereign wealth funds, hedge funds allocate more capital to emerging markets like India.

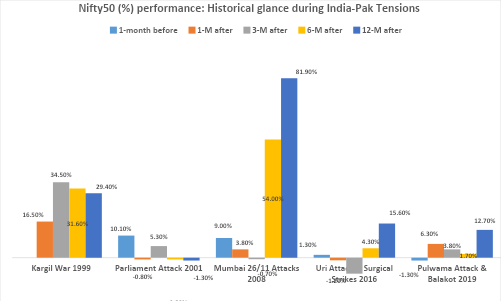

Below is the historical glance of how the Indian stock markets have performed during India-Pak tensions-

Read More Blogs

Multi-asset fund combines equities, bonds, silver and international securities, within a single portfolio; a structured

Historically, during Indian economic downturns equities fall out of favour while gold, which is generally

It’s been a tough couple of months for the Indian Equity market as form its