Multi Asset Funds Investment Strategy

Multi-asset fund combines equities, bonds, silver and international securities, within a single portfolio; a structured

Read More Blogs

Multi-asset fund combines equities, bonds, silver and international securities, within a single portfolio; a structured

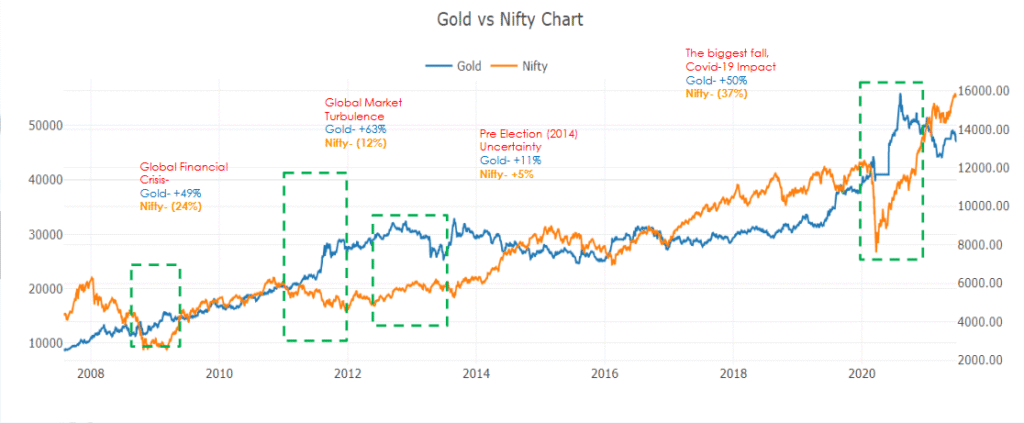

Historically, during Indian economic downturns equities fall out of favour while gold, which is generally

It’s been a tough couple of months for the Indian Equity market as form its