Multi Asset Funds Investment Strategy

Multi-asset fund combines equities, bonds, silver and international securities, within a single portfolio; a structured

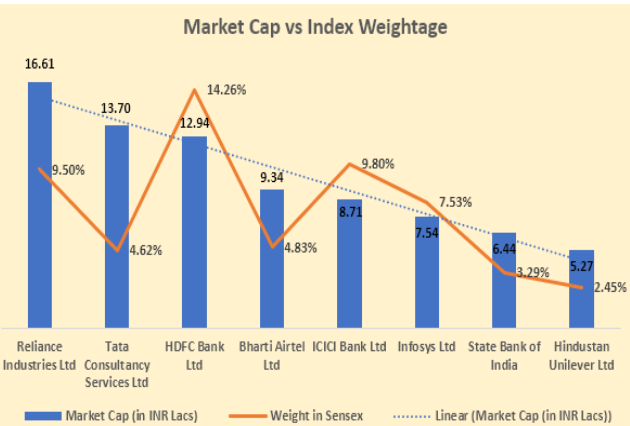

India’s Market Cap hits over 14 month-low by falling to $3.99 trillion, a 23% drop from $5.11 trillion. This sharp correction is triggered by a 2.6% decline in benchmark indices Sensex and Nifty, while Mid-cap and Small-Cap have dropped over 12% and 15% respectively.

Shouldn’t Market Cap decline less than indices, considering the new IPOs added to it?

To conclude, movement in stocks is not just about index movements, these structural differences distort their parallel linear movements.

Source – The figures and weightage % is as on 20.02.2025 given by BSE India. Top 8 stocks in terms of their market cap are taken into consideration for analysis.

Read More Blogs

Multi-asset fund combines equities, bonds, silver and international securities, within a single portfolio; a structured

Historically, during Indian economic downturns equities fall out of favour while gold, which is generally

It’s been a tough couple of months for the Indian Equity market as form its