Multi Asset Funds Investment Strategy

Multi-asset fund combines equities, bonds, silver and international securities, within a single portfolio; a structured

Multi-asset fund combines equities, bonds, silver and international securities, within a single portfolio; a structured formula to manage risks and returns.

Investing overseas through multi-asset funds has taken root in India and is gaining strong popularity due to several reasons – global markets have consistently outperformed Indian Markets over long-term periods; Indian rupee has depreciated steadily against US $ thus helps in preserving wealth; greater awareness and financial literacy.

Indians can invest overseas through multi-asset allocation funds through Indian AMC’s like ICICI Prudential, HDFC, DSP, etc offering Fund-of-funds, International ETF’s. HNI or experienced investors can invest directly through LRS. The most preferred overseas investments through LRS are US Stocks (Apple, Microsoft, Alphabet, Amazon, Tesla), US Based ETF (S&P 500) and thematic stocks ETFs.

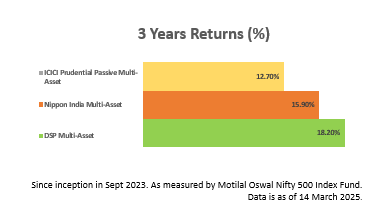

Overseas multi- asset allocation funds are the future of smart, diversified investing in India. These funds will evolve to include global megatrends like AI, Tech Innovation, thus blending Indian and overseas growth stories. These emerging trend in India, with a global tilt, will become more mainstream in days to come.

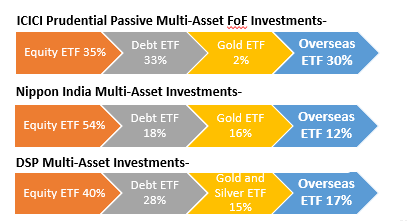

Multi-Assets Funds (FoFs)-

Direct Overseas Investments (FoFs)-

Read More Blogs

Multi-asset fund combines equities, bonds, silver and international securities, within a single portfolio; a structured

Historically, during Indian economic downturns equities fall out of favour while gold, which is generally

It’s been a tough couple of months for the Indian Equity market as form its