Multi Asset Funds Investment Strategy

Multi-asset fund combines equities, bonds, silver and international securities, within a single portfolio; a structured

Passive portfolio management aims to match the returns of a specific index by buying and holding a diversified portfolio in the same proportion as the index.

Active portfolio management is a hands-on approach where a fund manager actively buys and sells securities by analysing the undervalued and overvalued investments and making calculated decision with the goal of generating returns exceeding market average.

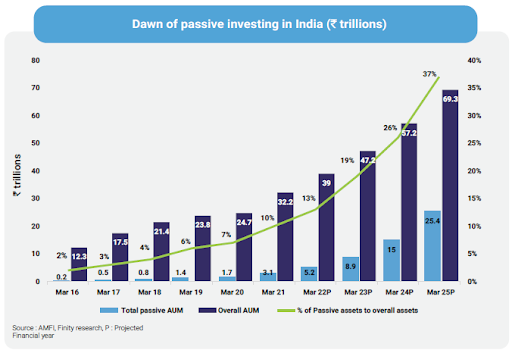

In India, passive portfolio management is becoming increasing popular with a significant shift towards index funds and ETFs as investors are inclining towards its benefits like lower expenses ratio and consistent long-term market performance. However, active management still holds a significant presence particularly among HNI who are seeking customised strategies and believe that skilled fund managers can outperform the market.

Because firstly India is the fastest growing economy and the stock market is not as efficient as developed markets, so skilled fund managers can identify undervalued stocks and capitalise on it at an early stage. Secondly, market is dominated by mid and small cap having high growth potential and high volatility (due to macroeconomic changes) so active fund managers can hedge risks and adjust portfolios accordingly.

The most important reason is Indian stock market is heavily influenced by investor sentiment, leading to mispriced stocks. Active managers can take advantage of this by using behavioural finance techniques.

To conclude, while passive investing is growing, active management is crucial for navigating complexities and unlocking higher returns. A mix of both can provide the best risk-adjusted returns.

Comment down your thoughts!

Read More Blogs

Multi-asset fund combines equities, bonds, silver and international securities, within a single portfolio; a structured

Historically, during Indian economic downturns equities fall out of favour while gold, which is generally

It’s been a tough couple of months for the Indian Equity market as form its